Trusted Firm

With Our Best Accountants

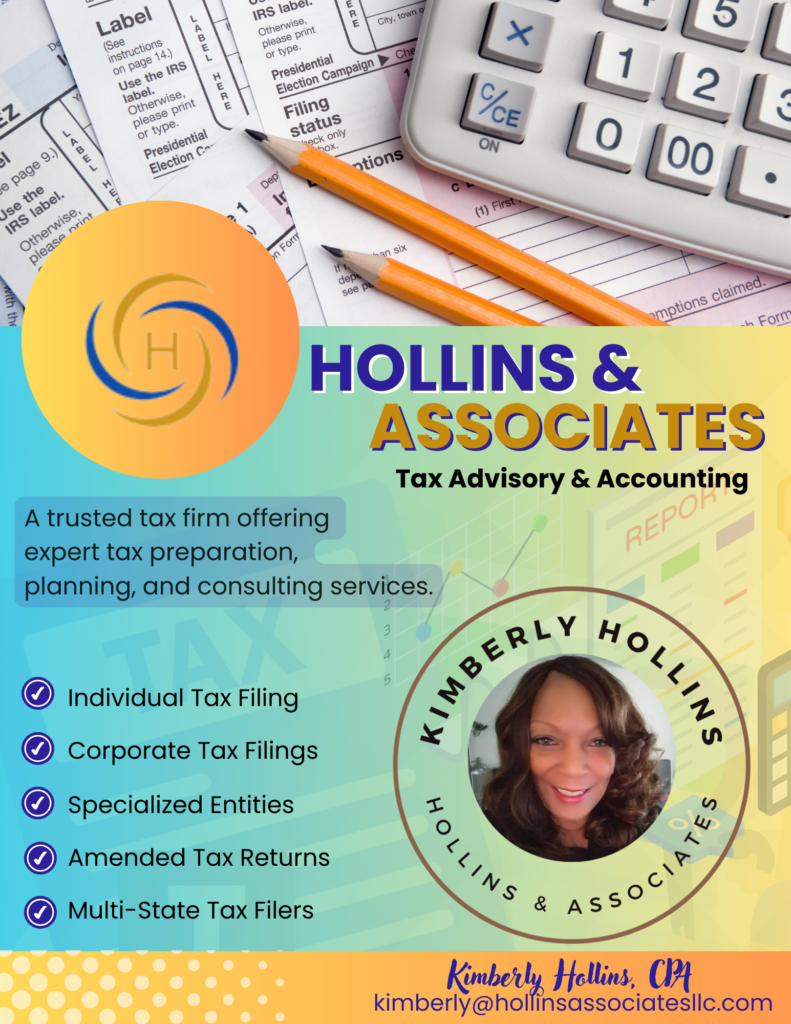

Hollins & Associats delivers expert financial solutions tailored to meet your unique needs. Our team of experienced professionals ensures accuracy, reliability, and personalized service for businesses and individuals alike. With us, your financial goals are managed with precision and care, building trust every step of the way.

30 +

Years

Experience

98%

Success Rate

File Taxes with Hollins & Associates

Two-Step Process to Become a Client

01

Client Onboarding

Let's begin by scheduling a consultation to discuss your tax needs and provide necessary documents, such as W-2s, 1099s, and prior tax returns. We'll assess your situation and set up a secure client profile for seamless communication.

02

Tax Preparation and Filing

Our experts will prepare your taxes with precision, identifying opportunities for deductions and credits. After your review and approval, we’ll file your returns promptly, ensuring compliance and maximizing your financial benefits.

Accuracate Filing

Ensure precise and compliant tax filings by leveraging advanced tools and expertise to minimize errors & reduce audit risks.

Max Tax Savings

Identify all eligible deductions, credits, and opportunities to minimize tax liabilities and maximize refunds for both individuals and businesses.

Tax Advisory

Provide tailored tax planning strategies that align with each client’s unique financial situation, goals, and compliance requirements.

Education & Support

Empower clients with knowledge and guidance on tax laws, ensuring they understand their financial position and feel confident in their filings.

Filing taxes is essential for legal compliance, financial clarity, and optimizing tax benefits.

What We Do

Compliance with Tax Laws

At Hollins and Associates, we ensure that your business is fully compliant with federal, state, and local tax regulations. Our experienced team works diligently to file your taxes accurately, helping you avoid penalties, interest charges, and legal complications. By staying on top of all regulatory requirements, we safeguard your business from the risk of audits and legal issues, allowing you to focus on growth and stability. Compliance also helps maintain your company’s good standing, which is essential for securing future business opportunities and partnerships.

What We Do

Strategic Financial Planning

Tax filing with Hollins and Associates is a vital tool for strategic financial planning. Our detailed tax returns offer insights into your business's cash flow, potential tax obligations, and financial outlook, helping you plan for the future. By reviewing your tax filings, we can identify trends in revenue, profit margins, and expenditures, enabling you to make informed decisions about investments, budgeting, and expansion. Our strategic planning services optimize your financial resources and help you set a path for sustained growth and success.

What We Do

Financial Health Assessment

Filing taxes with Hollins and Associates provides your business with a clear picture of its financial health. Our team offers a detailed breakdown of income, expenses, liabilities, and profitability, helping you assess whether your business is operating at a loss, break-even, or profit. This assessment gives you the tools to make informed decisions about budgeting, expansion, or cost-cutting strategies, and allows us to identify key areas for financial improvement & growth.

Our Skills

Expertise You Can Trust

Whether you're an individual, a small business owner, or a corporation, Hollins & Associates offers the expertise, precision, and personalized service you need to succeed.

Financial Services

Delivering exceptional tax and financial services backed by extensive expertise, years of industry experience, and a commitment to providing personalized, reliable solutions that meet the needs of each client.

Tax Optimization

Our professionals are experts in navigating complex tax laws, identifying opportunities for tax savings, offering strategic financial advice, and providing proactive solutions to optimize your financial health.

To Provide Exceptional Financial and Professional Services

What We Do

Tax Deductions and Credits

At Hollins & Associates, we guide businesses through the tax filing process to maximize deductions and credits, reducing your overall tax liability. Whether it’s operational expenses, depreciation, or credits for energy-efficient investments and hiring initiatives, our team ensures you take full advantage of tax-saving opportunities. By identifying and claiming the right deductions and credits, we help lower your tax burden, leaving you with more resources to reinvest in your business’s growth.

What We Do

Record of Earnings

A filed tax return from Hollins & Associates serves as an official record of your business's earnings, which is essential for securing loans, attracting investors, or making other critical financial decisions. We ensure that your tax filings are accurate and up-to-date, providing you with the documentation needed for banks and financial institutions to assess your business’s financial health. This official record enhances your credibility, giving potential investors and partners confidence in your business’s profitability and stability.